Effective tax optimization stands as a cornerstone in the financial well-being of individuals and enterprises alike. Entrepreneurs, with their unique business dynamics, can harness proactive tax planning to not only minimize liabilities but also enhance profitability and ensure compliance. This article delves into the nuances of year-end tax planning and the strategic use of deductions, with a focus on maximizing tax benefits for entrepreneurs. By leveraging tax-deferred investments and understanding the intricacies of retirement tax planning, business owners can safeguard their wealth and secure their financial future. We’ll explore these strategies in depth, providing actionable insights to help you navigate the complexities of tax law with confidence.

- Maximizing Tax Benefits for Entrepreneurs: Strategies for Year-End Tax Planning and Beyond

- – Emphasize the importance of year-end tax planning for small business owners to optimize their financial health.

- – Discuss various tax deductions and credits specifically advantageous for entrepreneurs.

Maximizing Tax Benefits for Entrepreneurs: Strategies for Year-End Tax Planning and Beyond

Entrepreneurs have a unique opportunity to maximize their tax benefits through strategic year-end tax planning and the implementation of tax minimization techniques beyond the fiscal year’s close. By carefully considering retirement tax planning, entrepreneurs can leverage tax-deferred investments that allow for growth within an investment vehicle while deferring the tax liability until a later time, often upon withdrawal during retirement. This strategic approach not only bolsters financial health but also ensures that more of the entrepreneur’s earnings are retained and reinvested into their business or other ventures.

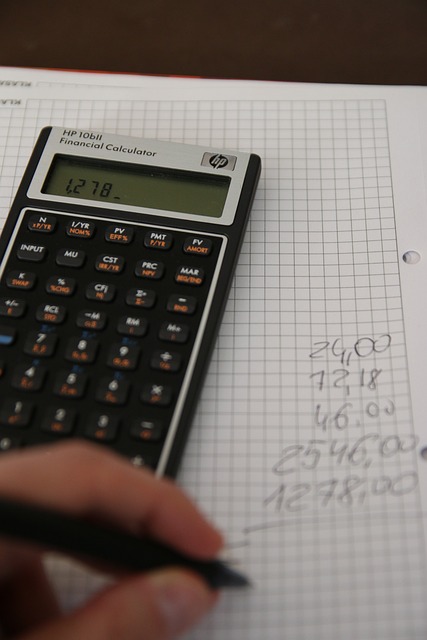

Moreover, as year-end approaches, it is prudent for entrepreneurs to scrutinize their expenditures to identify potential tax deductions that can significantly reduce their income tax liabilities. This may involve a thorough review of business expenses, inventory write-offs, and capital investments. By maximizing these deductions, businesses can improve their profitability figures, which in turn enhances compliance with tax regulations and optimizes cash flow management. Entrepreneurs should also consider the timing of income and expenses to ensure that they fall into different tax years, where advantageous, to further minimize their overall tax burden. Utilizing a combination of tax-efficient investments and astute financial planning can set the stage for sustained wealth preservation and growth.

– Emphasize the importance of year-end tax planning for small business owners to optimize their financial health.

Year-end tax planning is a critical exercise for small business owners looking to optimize their financial health and unlock tax benefits designed specifically for entrepreneurs. This strategic process involves carefully considering all potential income, deductions, and credits before year’s end to minimize taxes owed. By meticulously reviewing the books and forecasting future expenses, businesses can identify opportunities to maximize tax deductions, thereby retaining more capital. This proactive approach not only aids in cash flow management but also positions the business for sustained growth.

Furthermore, savvy small business owners should explore tax-deferred investments that can provide substantial retirement tax planning advantages. These investments offer the dual benefit of preparing for the future while simultaneously reducing current year tax liabilities. By understanding and leveraging these mechanisms, entrepreneurs can effectively shield their accumulated wealth from unnecessary taxation. Additionally, employing tax minimization techniques, such as timing income recognition and deducting expenses appropriately, ensures that small businesses operate on a level of financial efficiency that is both smart and legally compliant. This comprehensive approach to year-end tax planning is not merely about compliance; it’s about harnessing the full spectrum of available tax benefits to secure a robust financial future for the business.

– Discuss various tax deductions and credits specifically advantageous for entrepreneurs.

Entrepreneurs have access to a range of tax benefits designed to encourage business growth and innovation. These include various deductions and credits tailored specifically for their needs. For instance, start-up costs such as market research, organizational costs, and preopening expenses can be amortized over a set period, allowing entrepreneurs to reduce their taxable income. Additionally, section 179 of the IRS code enables businesses to immediately deduct the cost of qualifying equipment or software purchased or acquired during the tax year, which is particularly advantageous for those investing in technology or equipment necessary for operations. Year-end tax planning is crucial for entrepreneurs to maximize these deductions, ensuring they claim everything they are entitled to without triggering undue scrutiny from tax authorities.

Maximizing tax deductions extends beyond operational expenses; it also encompasses retirement tax planning. Entrepreneurs can leverage tax-deferred investments through plans like SEP IRAs, SIMPLEs, or solo 401(k)s, which allow for higher contribution limits than traditional IRAs. These contributions effectively defer taxes until a later date, often when the entrepreneur is in a lower tax bracket. Furthermore, by strategically timing income and expenses, entrepreneurs can manage their tax liabilities throughout the year, a practice known as tax minimization techniques. This approach involves careful planning of capital gains transactions to align with periods of lower income or when potential capital losses can be realized to offset gains. By being proactive and making informed decisions, entrepreneurs can significantly enhance their financial health through effective year-end tax planning and retirement tax planning strategies.

In conclusion, prudent year-end tax planning is a cornerstone of robust financial health for entrepreneurs. By leveraging tax benefits specifically designed for small business owners, individuals can maximize their tax deductions and capitalize on tax-deferred investments, ensuring a more secure financial future. Maximizing tax deductions isn’t just a strategic move; it’s an integral part of retirement tax planning and minimization techniques. Entrepreneurs who stay proactive in managing their taxes position themselves to enhance profitability while maintaining compliance. The insights provided herein underscore the necessity for business owners to engage with these strategies throughout the year, culminating in a well-executed year-end tax plan that optimizes wealth preservation and fiscal prudence.